Just before the start of the multi-billion dollar March Madness craze, Robinhood Derivatives partners with Kalshi to enter the rising predictive market.

Their deal was announced Monday, prior to the play-in set of games that begins Tuesday. The tournament goes full throttle with 16 tilts on Thursday and Friday.

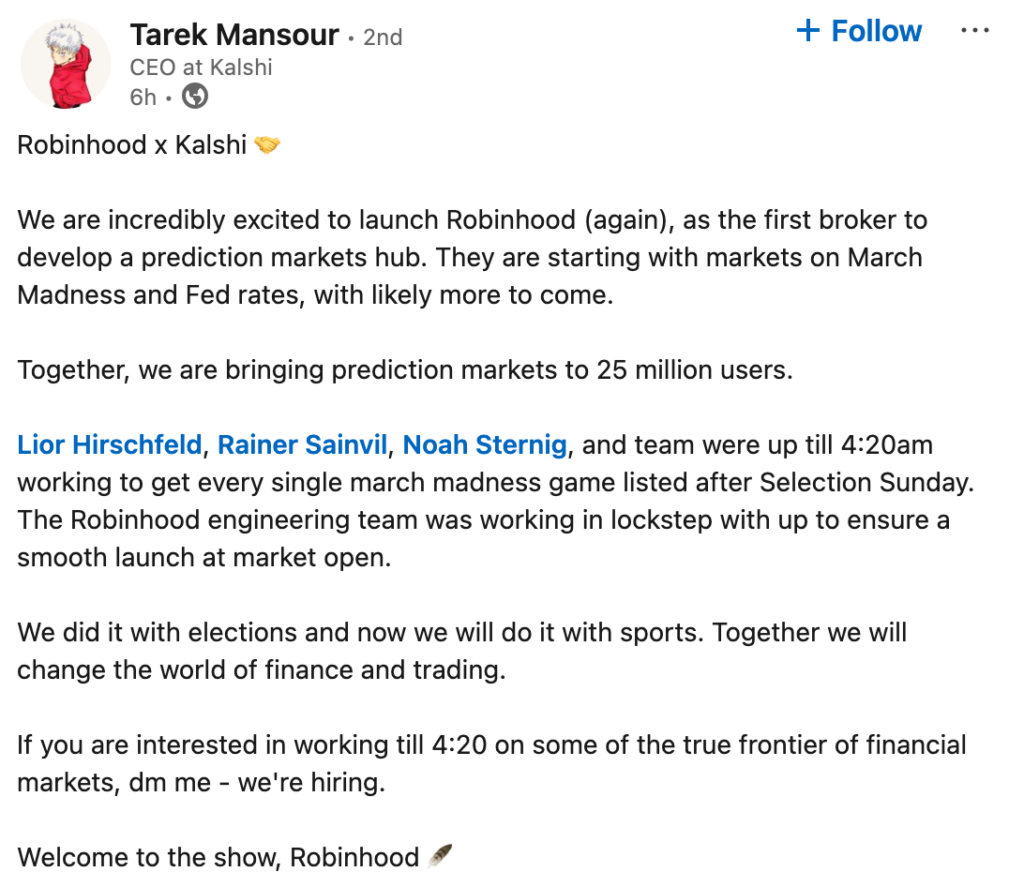

The company announced this prediction markets hub directly within its Robinhood App and on LinkedIn, allowing customers to trade on the outcomes of major events.

The prediction markets hub – and corresponding contracts – will initially be available across the U.S. through KalshiEX LLC, a CFTC-regulated exchange.

To be eligible, customers must apply and be approved for a Robinhood Derivatives account (or already have one). Additional trading prohibitions apply for these contracts.

Robinhood not only offers wagering contracts on the tournament games but also on the federal funds rate for May 2025. These contracts function similarly to individual game or futures bets at a sportsbook.

The company expects them to be tradeable daily from 8:00 AM ET until 3:00 AM ET.

Why this deal made sense for Robinhood

Robinhood’s larger prize is entering the crypto and derivatives markets to accept contracts on worldwide events. The opportunities range from presidential decisions to unemployment reports, weather, and speeches.

However, the company has not yet been able to fully access this market. It has had to navigate regulations with the CFTC, which formally requested that Robinhood “not permit customers to access” sports event contracts last month.

This was a setback for Robinhood, which wanted to tap into Super Bowl betting. However, the company complied and has maintained close contact with the CFTC, hoping to build an alliance.

Robinhood aims to secure long-term access to the predictive market by working within the system instead of pursuing legal action.

Kalshi’s CFTC regulation gives Robinhood a strategic entry point into the space. This partnership provides a key foothold in the predictive world.

“We believe in the power of prediction markets,” said JB Mackenzie, VP & GM of Futures and International at Robinhood. “We’re excited to offer our customers a new way to participate.”

Robinhood emphasized that prediction markets leverage financial market structure to improve liquidity, transparency, and price discovery.

What the company offers right now

Robinhood is rolling out event contracts for the men’s and women’s college basketball tournaments (March 20 – April 7, 2025).

Contract types:

- Championship Outcome – Bet on which college team will win the men’s or women’s championship trophy.

- Bracket Performance – Speculate on the outcome of individual games.

Robinhood is also launching contracts on the Fed funds rate for May 2025, starting the week of March 17, 2025.

The federal funds rate is the overnight lending rate between banks, set by the Federal Open Market Committee (FOMC). It is most commonly adjusted during FOMC meetings, which occur eight times per year.

This event contract will be based on the FOMC decision on May 7, 2025.

You’ll be able to open Yes or No contract positions for these outcomes:

- Will the upper bounds of the Fed funds rate be:

- Above 4.00%

- Above 4.25%

Robinhood charges $0.01 per contract bought or sold. There are no additional fees for holding a position until settlement.

Depending on the exchange, an exchange fee of $0.01 per contract may apply, or a spread may be built into the contract price.

What this says about the future

Prediction markets are growing. Gamblers already bring heavy action to sports betting and financial markets. Now, they want more ways to speculate. The race is on to see who will dominate this space.